…a compilation of most recent banking regulatory developments from around the world. October 30, 2017: 1. United States: Federal Deposit Insurance Corporation, the Federal Reserve System, and the

November 6, 2019

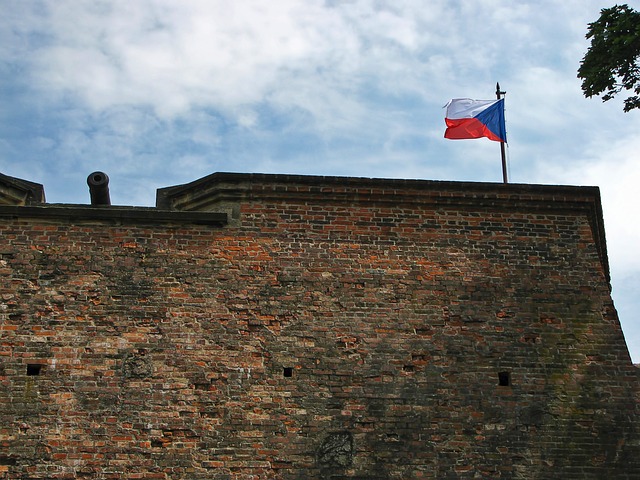

Czech National Bank launches FinTech contact point

The Czech National Bank (CBN) has established a FinTech contact point. In so doing, the CBN is following the lead of the European Supervisory Authorities, which already have FinTech support programs. The FinTech contact point is aimed at promoting the introduction of innovative technologies on the Czech financial Europe

November 4, 2019

US federal agencies finalize changes to resolution plan requirements

The federal agencies have finalized a rule that modifies their resolution plan requirements for larger financial firms while reducing the same requirements for smaller firms that present less financial risk to the system. The resolution plans executed by the largest firms since 2012 had improved their governance, resolution strategies North America

October 30, 2019

EBA proposes to further strengthen depositor protection in the EU

The European Banking Authority has published its second opinion on implementing the Deposit Guarantee Schemes Directive in the EU. The opinion focuses on payouts by deposit guarantee schemes (DGSs) and proposes a number of changes to the EU legal framework. The proposed changes are aimed at strengthening depositor Europe

October 29, 2019

US: Federal agencies propose rule to amend the swap margin rule

US federal agencies have proposed to change the swap margin rules to facilitate the implementation of prudent risk management strategies at certain banks and swap entities. The swap margin rule would no longer require swap entities to hold initial margin for uncleared swaps with affiliates. Inter-affiliate transactions would still be North America

October 29, 2019

US: Regulatory agencies simplify capital calculation for community banks

US federal bank regulatory agencies have issued a final rule simplifying capital requirements for community banks by allowing them to adopt a simple leverage ratio to measure capital adequacy (leverage ratio framework). The leverage ratio framework removes requirements for calculating and reporting risk-based capital ratios for a qualifying community North America