BaFin has reduced the countercyclical buffer rate to zero percent effective April 1, 2020. According to the regulator, the rate reduction is aimed to strengthen the resilience of the

November 21, 2019

Australia: Regulator consults on further amendments to leverage ratio requirement

The Australian Prudential Regulation Authority (APRA) has released for consultation draft prudential standard on the leverage ratio requirement for authorised deposit-taking institutions. The consultation sets out APRA’s response to industry’s previous submissions. It seeks to incorporate changes to the Basel Committee on Banking Supervision’s leverage ratio standard. Stakeholders Oceania & Antarctica

November 21, 2019

Australia: Regulating governance, culture, remuneration and accountability risks

The Australian Prudential Regulation Authority (APRA) plans to intensify efforts to lift standards of governance, culture, remuneration and accountability (GCRA) across the industries it regulates. APRA’s intensified approach to GCRA aims to strengthen the resilience of financial institutions. The approach will address issues such as poor risk governance, Oceania & Antarctica

November 21, 2019

Basel Committee: Report on open banking and application programming interfaces

The Basel Committee on Banking Supervision (Basel Committee) has published its Report on open banking and application programming interfaces (APIs). The report monitors the evolving trend of open banking observed in Basel Committee member jurisdictions and the use of APIs. It discusses the implications of these developments on Other

November 20, 2019

Canada: OSFI publishes findings from consultation with deposit-taking institutions

The Office of the Superintendent of Financial Institutions (OSFI) has published findings from consultation with deposit-taking institutions. OSFI had commissioned an independent research firm to consult with deposit-taking institution CEOs, CFOs and other senior executives. Comprising of a series of confidential interviews, the purpose of the consultation was North America

November 19, 2019

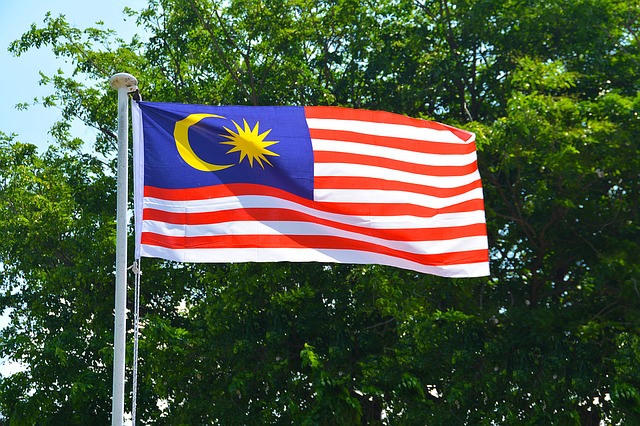

Malaysia: Policy document on fair treatment of financial consumers

Bank Negara Malaysia has issued a policy document on Fair Treatment of Financial Consumers. The policy document aims to foster high standards of responsible and professional conduct in a financial service provider (FSP). The document seeks to promote a culture where the interests of financial consumers are an Asia & South America